This program is no longer accepting applications as of Nov. 13.

What financial documentation is required to apply for the Pinellas CARES Local Business Grant?

- Correct W-9 information that matches your IRS business tax return.

- Proof of Legal Operation

- Updated, current Municipal Business Tax Receipt, if applicable.

- If you are located within unincorporated Pinellas County or a city without a Municipal Business Tax Receipt (Belleair Beach, Belleair Shores, Indian Shores), you are still eligible for this grant and can submit any of the following documentation instead:

- Copy of your “active” state business registration from Florida Division of Corporations (if applicable) or

- Other documentation showing the business meets all regulatory requirements from Pinellas County or the municipality in which the business is located. Depending on your circumstance and business type, this may include:

- License from the Florida Department of Professional Regulation

- License from the Dept. of Health

- Captain’s license

- Rental documentation, and/or

- Department of Revenue Resale Certificate

- 2019 Federal Tax Return – whichever form is applicable to your type of legal business entity (IRS Schedule C, Form 1120, Form 1120-S, Form 1065). If you haven’t yet filed for the 2019 tax year, you may apply for a microgrant or you can wait to apply until you file your taxes. The extension period for business taxes expires September 15, 2020 and for personal taxes it expires October 15, 2020.

Important W-9 Information for all applicants

Enter your W-9 information carefully. For your application to be approved each field you enter on your application must match the information on your business tax return exactly.

Form 1040, Schedule C:

You are an individual, a sole proprietor or a single member LLC and you should select that choice in the drop-down box in section C of the application.

- Put your personal given name (as shown on the Schedule C) in the application.

- Include your “Doing Business As” name (if you have one) in Box B.2 of the application.

- The address on B.4 of the application should be the address to which you want the check to be mailed. This should match the address on your tax return.

- Your “Taxpayer Identification Number (TIN)” in box B.5 will be your personal social security number (SSN), and this should match the SSN shown on your tax return.

Form 1065:

You have a partnership or a “Limited Liability Company – P.”

- If you are an LLC, you should select that choice from the drop-down menu in section B.3 of the application.

- Otherwise, you should select the “Partnership” choice on the drop-down menu in Section B.3 of the application.

- Put the legal name of your partnership (as it appears on Form 1065) in Box B.1 of the application.

- Include your “Doing Business As” name (if different from the partnership name) in Box B.2 of the application.

- The address on Line B.4 of the application should be the address to which you want the check mailed and should match the address on your tax return.

- Your “Taxpayer Identification Number (TIN)” in Box B.5 will be your Employer Identification Number (EIN) as it appears on Form 1065 Do not use your Social Security Number.

Form 1120:

You have a C Corporation or a “Limited Liability Company – C.”

- If you have an LLC, you should select that choice from the drop-down menu in section B.3 of the application

- Otherwise, you should select the “C Corporation” choice in the drop-down menu in Box B.3 of the application.

- Put the legal name of your corporation (as it appears on Form 1120) in Box B.1 of the application.

- Include your “Doing Business As” name (if different from the corporation name) in Box B.2 of the application.

- The address on line B.4 of the application should be the address to which you want the check mailed and should match the address on your tax return.

- Your “Taxpayer Identification Number (TIN)” in Box B.5 will be your Employer Identification Number (EIN) as it appears on Form 1120 Do not use your Social Security Number.

Form 1120S:

You have an S Corporation or a “Limited Liability Company – S.”

- If you are an LLC, you should select that choice from the drop-down menu in section B.3 of the application.

- Otherwise, you should select the “S Corporation” choice in the drop-down menu in box B.3 of the application.

- Put the legal name of your corporation (as it appears on Form 1120S) in Box B.1 of the application.

- Include your “Doing Business As” name (if different from the corporation name) in Box B.2 of the application.

- The address on line B.4 of the application should be the address to which you want the check mailed and should match the address on your tax return.

- Your “Taxpayer Identification Number (TIN)” in Box B.5 will be your Employer Identification Number (EIN) as it appears on Form 1120S. Do not use your Social Security Number.

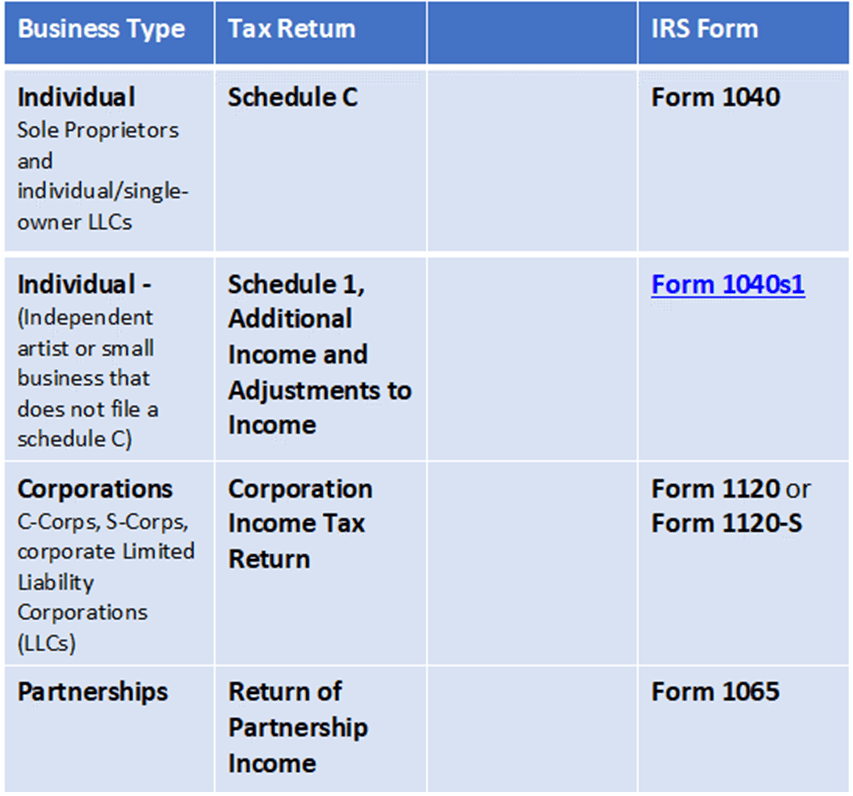

What tax documents are required to apply?

Individual (sole proprietors and individual/single-owner LLCs)

Individual – (Independent artist or small business that does not file a schedule C)

- Schedule 1, Additional Income and Adjustments to Income (Form 1040s1)

Corporations (C-Corps, S-Corps, corporate Limited Liability Corporations (LLCs))

- Tax Return (Form 1120 or Form 1120-S)

Partnerships

- 2019 Return of Partnership Income (Form 1065)

NOTE: Businesses applying without the applicable federal tax return will work with the County’s microgrant program partners to submit:

- 2019 profit and loss statement AND

- 2019 tax return extension OR amended 2019 tax return.